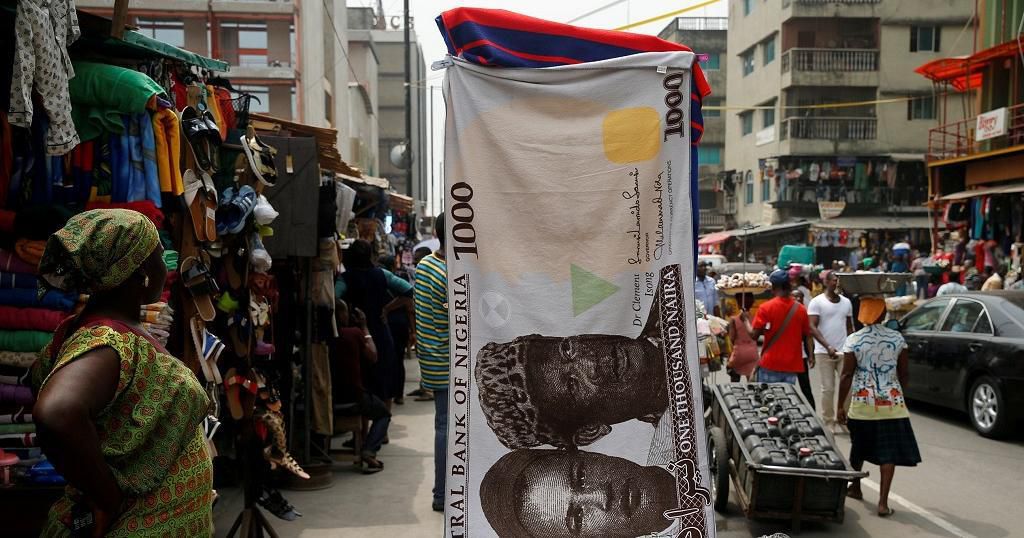

As the implementation of the tax reforms draws closer, many Nigerians have continued to express concerns about specific provisions of the laws.

Public anxiety seems to be growing over fears that tax authorities will begin making direct deductions from citizens' bank accounts once the new tax laws take effect on January 1, 2026. Since it was enacted into law, the Nigeria Tax Act 2025 has sparked heated public debate and controversy.

Though public discussions so far have been characterised mainly by misconceptions, deliberate misinformation, and inaccurate assumptions that continue to fuel suspicions against the government, the issues raised remain relevant to average Nigerians.

For instance, an X account with @gmltony posted that: "I want to remind you all that Tinubu will begin taxing us from January 2026. As in, after working, you will give Tinubu 20% of your hard-earned money." This is a misrepresentation of the facts, as the new laws will only enhance tax collection and management, rather than introducing new rates.

With the laws kicking in, many Nigerians are grappling with how the incoming tax regime will affect their personal income in a struggling economy. Concerns have ranged from higher tax payments to taxation of bank savings and multiple tax responsibilities.

However, the current issues stem from the possibility that the government could unilaterally calculate taxes and deduct them directly from individuals' bank accounts.

Social Media Uproar

Recent social media chatter has focused on this subject following the comments made by Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, on the MIC ON Podcast with Seun Okinbaloye.

In a clip currently making the rounds, Oyedele affirmed that the law empowers tax collectors to deduct amounts from individuals' bank accounts to enforce compliance with the Personal Income Tax (PIT) law.

He said the government can "collect the taxes you owe" directly from your bank account once you have been afforded the due process to explain yourself, and you refuse.

While this excerpt doesn't capture the full context of his comment, it confirmed the fears of many Nigerians. But, is this something that citizens should dread? Maybe or maybe not.

However, a deeper understanding of the Nigerian tax ecosystem may help you reach a more informed conclusion.

rather than introducing new rates.

What You Should Know

)

The major transformation brought by the tax reforms is the complete overhaul of the existing ecosystem.

Under the outgoing arrangement, tax collection, remittance, and administration are a hybrid of manual and digital processes, making it impossible for the government to capture all the taxable individuals.

With a population of over 200 million, the Federal Inland Revenue Service (FIRS) estimated that 86 million Nigerians are actively employed, while only roughly 10 million are currently captured in the tax net. This figure falls short of the global standard of 50% of active citizens being in the tax net.

It's for this reason that the new laws aim to cast a wider net by integrating technology to identify tax evaders, creating a fairer, more rewarding system for the majority. So, if you're already paying your taxes regularly, you can rest easy here.

Why You Can’t Escape the Taxman

![How to Calculate Tax on Your Salary in Nigeria: 2026 Easy Guide. [Getty Images]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/26072024/a77466d2-ea00-4ca6-ae55-046eb945bbba)

The law mandates that anyone earning income in Nigeria, whether through paid employment, self-employment, business, or investments, must have a Tax Identification Number (TIN).

TIN is a 13-digit unique identifier issued to individuals and businesses for tax purposes in Nigeria. It serves as a personal reference for tracking tax records, payments, and compliance with government regulations.

It's required for filing your annual tax returns and for all other tax-related transactions. Also, it helps the tax authorities to appropriately credit tax payments and track your tax compliance history over the years. This applies to both individuals and business owners.

Here is the interesting part: one of the major requirements to obtain your TIN is your Bank Verification Number (BVN). With your BVN, the authorities could track your financial activities in all bank accounts linked to your name.

Why Govt May Debit Your Bank Account

According to the new tax laws, you are primarily required to declare your income to the authorities, who will, in turn, verify the claims and calculate the appropriate tax to be paid.

But if an individual fails to comply, the taxman has been empowered to gather intelligence through the BVN. The authorities will piece together activities from the person's bank account(s), including travelling expenses, card payments, and phone and electricity bills.

This procedure, known in the tax space as a best judgment assessment, helps the taxman assess your lifestyle and bill you accordingly.

"We've also introduced what we call fiscalisation, which means when you issue an invoice for goods and services, the government gets a copy automatically.

"What we're trying to do with that is, instead of relying on people to be honest and patriotic to tell us their income, we want to use the system to find out. Your primary role is to declare your income yourself; then, the government, on the other hand, will do an ecosystem validation," Oyedele explained.

Based on this information, the government would calculate your taxes and notify you of the payment deadline. If you disagree with the rate you're charged, the law allows you to appeal to the Tax Ombuds office, but once that process is resolved, you're mandated to pay whatever amount is agreed.

However, suppose an individual fails to act after being notified of their tax obligation. In that case, the law allows the government to deduct the tax directly from their bank account once the deadline expires.

"By the time the system validates what you're doing, we will be able to know that you've not paid tax..... If you can't explain yourself and your tax is one million naira, under these new tax laws next year, if you have a bank account, we can debit your bank account. Once you have been given the due process to explain yourself and you refuse, the government can substitute what you have to collect the taxes you owe," Oyedele stated.

Who Will Be Affected?

Not every taxable individual can be affected by this outcome. If you're an employee, your Pay As You Earn (PAYE) tax is deducted by your employer and remitted directly to the government. This means you're not at any risk here.

The tax authorities reserve this action for self-employed individuals and companies, who are mandated to self-declare their income.

Comments